In most cases, the complete system from software to funding might be done from a household, Workplace, or nearly everywhere that has a WiFi connection. At PrimeRates you'll be able to obtain features from top national on the net lenders that specialise in own loans.

Don't forget, you could however qualify for any $two,000 own mortgage with truthful or poor credit, it just may suggest that you'll have to pay out a lot more in interest and costs. Lenders will likely have their own personal list of demands, together with credit history rating, so take a look at alternatives and stay focused on ways to achieve a good credit rating score.

This will likely lead to similar working day funding, but final results may fluctuate as well as your lender may have rules that limit our capacity to credit history your account. We're not to blame for delays which can arise resulting from incorrect routing quantity, account variety, or faults of one's fiscal establishment.

If PenFed doesn’t approve you to get a bank loan or will give you a superior charge, you could implement again using a co-borrower, which can assist you to obtain a lower interest level.

An crisis financial loan is generally a short-time period, superior-interest level bank loan. Time to repay it could be a handful of weeks to many months for lesser quantities. Some emergencies are much more expensive, just like a new roof, so these would've a longer amortization.

A $two,000 personal loan could possibly be regarded a small particular bank loan that may be useful for rapid or unexpected emergency expenditures. Occasionally, using a smaller own financial loan to include emergency expenditures could be less expensive than using a credit card Ultimately. And since on the web lenders have streamlined the loan software and approval course of action, you'll be able to frequently see The cash within your account the identical or the next business enterprise working day, Despite the fact that funding occasions can vary.

More substantial financial loan quantities may be a advantage for some, but it could be a detriment to borrowers who only require a handful of thousand pounds or much less

Assuming the lender approves the bank loan, you’ll receive the money, minus any origination rate the lender rates. You’ll also start out shelling out again the personal loan on the agreed-upon repayment term. Consider putting together computerized payments to ensure you don’t miss out on any.

Why pick out: LendingPoint is really a respected lender Which may be a good selection for fair credit history borrowers that are in need of instant cash for an emergency price. They provide quickly approval times and may fund accounts in as tiny as just one small business day.

You can even lessen your expenditures of borrowing by picking a shorter mortgage time period. The downside of choosing a short financial loan phrase, having said that, is that your monthly payments will probably be larger.

Secured loans are backed by collateral, for instance a motor vehicle title or checking account. However, you may eliminate your collateral when you slide driving on payments.

Eiloan.com has NO power to predict or estimate what supplemental expenses will likely be incurred within the occasion of late, partial, or non-payment. Eiloan.com also has NO control or expertise in any bank loan agreements or specifics in between both you and your lender.

Most personal loans are unsecured, so a lender bases its acceptance selection primarily on your click here credit rating and income. Here are several popular qualification demands for getting a $2,000 financial loan:

An APR is actually a percentage that expresses the amount fascination and costs you will have to spend on a mortgage. When shopping various lenders for a private bank loan, Be sure to think about the APR to check Each and every from the personal loan provides. If you glimpse only with the interest amount, you are not getting the whole picture of exactly how much a specific personal loan will cost you.

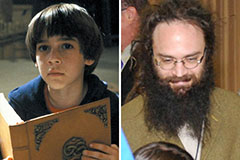

Barret Oliver Then & Now!

Barret Oliver Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!